Preparing for another savings pinch

The bad news for savers relying on income returns is set to continue

Australia’s underlying level of inflation is continuing to fall, and which paved the way for another official interest rate cut when the Reserve Bank of Australia (RBA) board met earlier in the month.

It was welcome news for borrowers, but not for most savers – especially the millions of Australians with money tied up in savings accounts who are heavily dependent on regular account interest payments.

When borrowing interest rates are reduced, account savings interest rates typically fall in tandem.

In fact, many financial institutions who had been pre-empting another rate cut and had already quietly started to reduce their account savings rates.

According to rates comparison website Canstar, only a handful of banks are now offering savings rates above 5%. And, in the majority of cases, receiving those rates are conditional on meeting minimum monthly deposit amounts or transaction numbers.

Just like the rates on savings accounts, term deposit rates have also been declining steadily over time, since well before the RBA lowered its official interest rate by 0.25% to 4.10% in February this year – its first rate cut since November 2020.

In fact, RBA retail deposits and investment rates data shows term deposit rates across a range of durations have been steadily declining since July 2024.

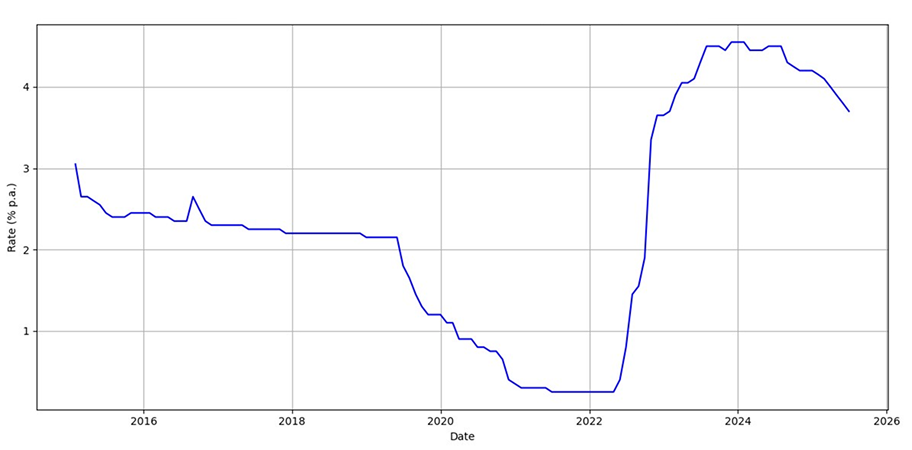

For example, the average 12-month term deposit rate for a $10,000 amount has been progressively reduced nine times since July 2024, from a peak of 4.50% to an average rate of 3.70% at June 30, 2025.

The average three-year term deposit rate for a $10,000 amount has been progressively reduced six times over the same period, from a peak of 3.95% in July 2024 to 3.05% at June 30, 2025.

The chart below tracks the average 12-month term deposit rate for $10,000 amounts between January 1995 and July 2025, highlighting the rise in account interest rates from their historical low point in early 2022 to their peak, and then their gradual decline since the middle of 2024.

Going down: Average term deposit rates have slipped

Banks’ Term Deposit Rates ($10,000) – 1 Year (Jan 2015 to Jun 2015)

Source: Reserve Bank of Australia.

Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance.

Implications for savers and retirees

Many Australians, especially retirees, rely on the interest earned on their savings to cover their living expenses, and any reduction in interest rates can mean a substantial decrease in their income.

This has been the reality for many people over the course of the last year, and further cuts are on the near-term horizon.

The decline in savings rates also has broader implications for the economy.

When savers earn less interest on their deposits, they have less money to spend, which can lead to a decrease in consumer spending. This, in turn, can slow economic growth, as consumer spending is a key driver of economic activity.

Additionally, lower savings rates can discourage people from saving, which can have long-term implications for financial stability.

Turning savers into investors

New research released has estimated that the implementation of certain retail investment reforms in Australia could potentially unlock at least $185 billion in excess cash savings and help more Australians achieve greater financial security.

These reforms include facilitating access to affordable financial advice, introducing tax incentives to boost investment outside of superannuation, improving financial literacy levels, and increasing fee transparency and competition.

For retail investors, the decline in term deposit rates and savings rates presents a challenge. With returns on traditional savings accounts and term deposits declining, some investors may need to look for alternative investment options to generate income.

While there are other income-generating options available, such as dividend-paying stocks and bonds that typically offer higher interest rates than savings accounts and term deposits, it is important for investors to carefully consider the risks and rewards of these investments before making any decisions.

In the meantime, the income road ahead for many people needing to generate income from their savings may become increasingly challenging as interest rates continue to fall.

Source: href=”https://www.vanguard.com.au/personal/learn/smart-investing/investing-strategy/preparing-for-another-savings-pinch”>Vanguard August 2025

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2025 Vanguard Investments Australia Ltd. All rights reserved.