How to spot a scam website

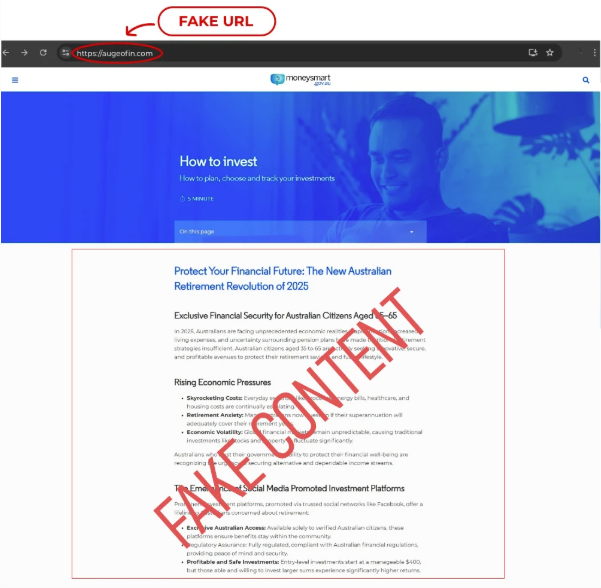

Recently, there was an alert about the ASIC Moneysmart website being impersonated. It’s part of a growing – and increasingly sophisticated – trend of scammers targeting reputable, high traffic websites.

These days, websites can be very easily set up and look quite professional without much effort, thanks to templates.

So, whether you’re visiting the website of your bank, insurer, or a government agency, how can you be sure you’re in the right place? Here are some top tips.

Check the website address (URL) carefully

Does the URL match the content: Take the time to check a website’s URL. Many scammers take advantage of people not checking by showing content from known and trusted brands.

Be wary of shortened links: If you receive a shortened link (like bit.ly), only click on it if you’re already confident that the website is genuine.

Be wary of redirects: if a page ‘refreshes’ multiple times before it loads, with different content or a different URL, this may be because of multiple redirects – a warning sign of a scam website.

Search for the website: If the website is from a major brand or is showing a news article from a well-known news source, search for the name or title in a search engine. Compare and check that it brings up the same URL.

How to check a URL

The URL (web address) of the webpage you’re on will be in the browser bar at the top of your webpage.

You can also check the URL of any links on a webpage simply by hovering your mouse over the link.

Research the website

Search for scam alerts and warnings

You can check for alerts in a few ways:

- Check the Investor alert list – Moneysmart.gov.au to see if ASIC has warned about the website or the entity operating the website.

- Search for the URL or business name and the word ‘scam’ to see if consumers have warned others about losing money to a website online.

- Check for international regulator warnings via International Securities & Commodities Alerts Network (I-SCAN).

Check how old the website is

Scam websites are often online for a short period of time before they get shut down or move on to a new website.

You can check how old a website is by searching for ‘WHOIS search’ and conducting a free search. The ‘Registered On’ date is the date that a website was registered – anything newer that 6 months is a red flag.

Look closely at the website content

Unusual language: If a website uses an odd turn of phrase, try searching online for it. If many websites turn up which use the same wording, be cautious as they may be scam websites that were set up by the same person.

Check for spelling and grammar errors: Scam websites often have poor language quality or awkward phrasing. Read it carefully to see if it makes sense.

Being encouraged to invest? Here’s what to check before trusting a business with your money, and how to spot the signs of a scam.

Check the business information

Check for a physical address, phone number and email. Legitimate businesses provide real contact details, and any license or registration details, clearly.

Be on alert for these red flags:

- Unusual contact channels: A website only offers communication via anonymous web forms, chat bots and social media accounts like WhatsApp, Signal or Telegram instead of providing a physical address and telephone number.

- Vague address information: They list a large office building or coworking space as the office address without providing details like a floor number. They may provide a telephone number with a country code that doesn’t match the country of the physical address that has been provided.

- Stock image staff photos: They use AI generated or stock photos for members of its staff. It is easy to check where an image comes from with a free reverse image search offered by a number of well-known search engines.

- No licensing information for financial services : If the business is offering investments or other financial services, they should display license and registration details clearly. Speak to us before you consider investing.

- Unusual digital footprint: A business may claim to work with a large client base or funds, but they have a limited web or social media presence.

- Negative or overly positive reviews: There are negative reviews about the business online. Also be cautious if the reviews are overly positive or all sound similar – they may be fake. You could also check comments on their social media accounts.

Other warning signs of scam websites

Here are other signs you may be looking at a scam website:

- A significant number of ads : a website may have more ads than content, or you are seeing a lot of pop-ups.

- Broken links : If there is only one page, or links do not work, this may be a red flag. This can include broken links to their social media.

- Unusual payment methods: If the business is asking for investments or payments using cryptocurrency, international funds transfer, or other unusual methods such as gift cards.

- Multiple company websites: A search reveals more than one URL for this company – this might mean that one of them is an impersonation.

Always be cautious of scammers impersonating legitimate businesses, especially if you are looking to invest your money. Look for signs of imposter bond scams and other investment scams.

Report all scams to Scamwatch

Act fast if you suspect a scam

Scamwatch , run by the National Anti-Scam Centre (NASC), collates information about all scam types. They use this information to warn and protect the public. Scamwatch also sends information to other agencies, including ASIC and ReportCyber, to help stop scammers. Report all scams, including investment scams, to Scamwatch.

Reproduced with the permission of ASIC’s MoneySmart Team. This article was originally published at https://moneysmart.gov.au/online-safety/how-to-spot-a-scam-website

Important note: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person. Past performance is not a reliable guide to future returns.

Important

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.