Men earn nearly $10,000 more than women in bonuses and overtime pay, fuelling the gender pay gap: new data

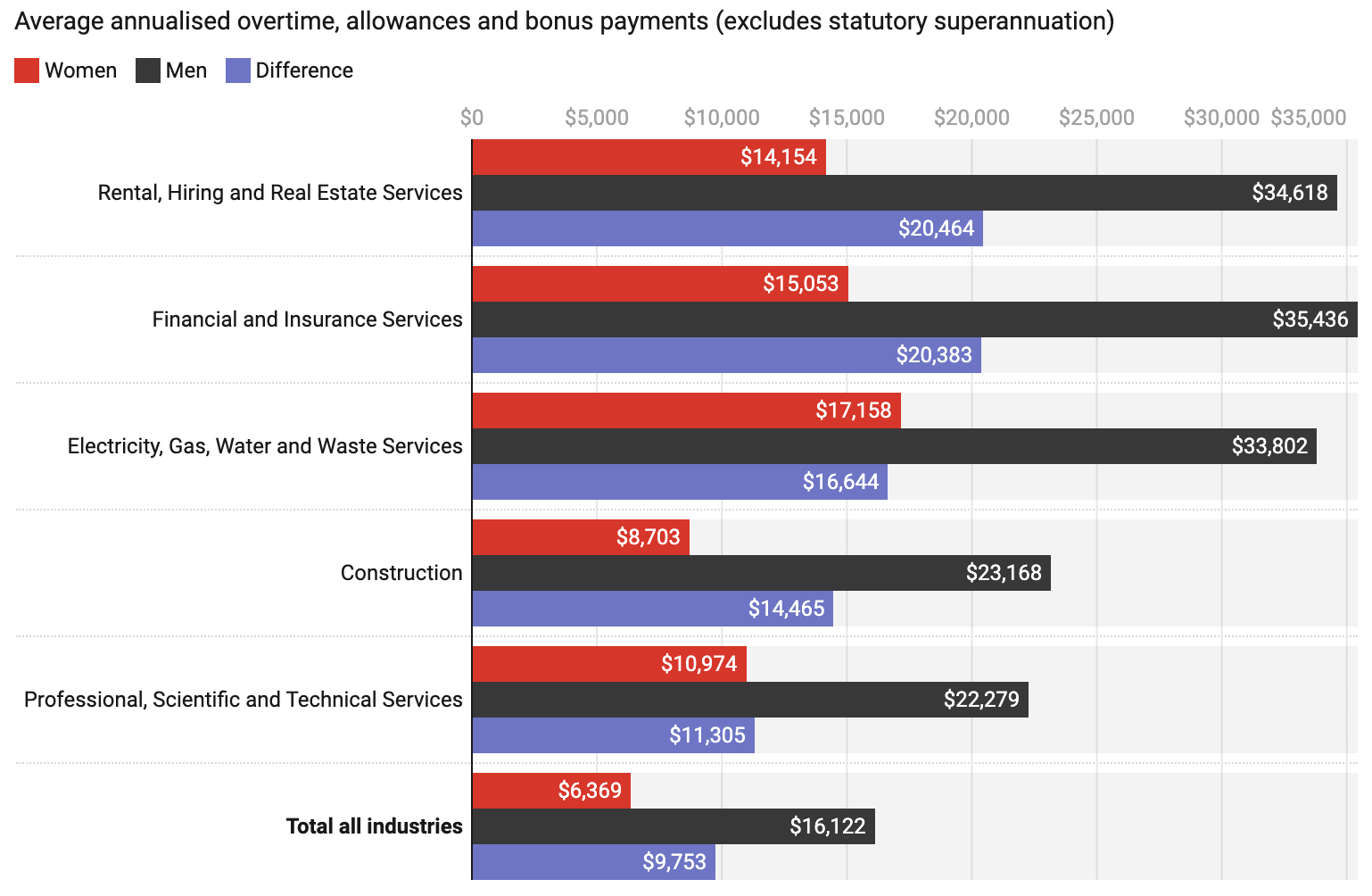

Men are earning on average A$9,753 more than women each year in the form of performance bonuses, allowances and overtime pay.

That’s according to the latest gender pay gap data released on Thursday by the Workplace Gender Equality Agency. It covers more than 8,000 private companies for 2024–25, employing more than 5.4 million workers across Australia.

The overall gender pay gap fell to 21.1%, compared to 21.8% in 2023–24. But the gap in discretionary pay makes up a big chunk of the total gender pay gap of $28,356.

Where gaps in bonus and overtime are widest

The gender gap in discretionary remuneration – payments made on top of a worker’s base salary and excluding mandatory superannuation – balloons in particular industries.

In the rental, hiring and real estate industry, these additional payments average $34,618 annually for men and $14,154 for women. That’s a gap of $20,464.

In financial and insurance services, the gender gap in additional payments comes to $20,383. In electricity, gas, water and waste services, it’s $16,644.

Top five industries with the largest gender gap in discretionary payments

Chart: The ConversationSource: WGEA (2025) Australia’s Gender Equality Scorecard 2024-25

Studies have found that when gender gaps have successfully narrowed, it’s generally the base salary component that has improved. The gap in discretionary payments is more stubborn.

Blame ‘greedy jobs’

Partly these gender differentials in discretionary payments are due to men working overtime hours, which are paid at a higher hourly rate.

But this gender pattern in overtime reflects rigid gender roles. While men work longer hours , women are shouldering the bulk of unpaid domestic labour and care in the home.

These patterns arise from employers’ expectations in many jobs that employees will be available 24/7 to work very long hours (such as in finance) or non-standard hours like weekends (such as in construction).

It’s what Nobel Prize-winning economist Claudia Goldin calls “greedy jobs”.

Longer hours are rewarded through bonuses and higher hourly pay rates. What’s the logical thing, financially, for households to do? For one partner to work the extra hours and leverage overtime rates, while the other takes the lion’s share of domestic work and care.

Greedy jobs cause couples to split their roles. And gender stereotypes get further entrenched.

Parental leave is growing among men

This brings us to another of the Workplace Gender Equality Agency’s latest findings on a policy that can undo these entrenched gender patterns: fathers’ usage of paid parental leave.

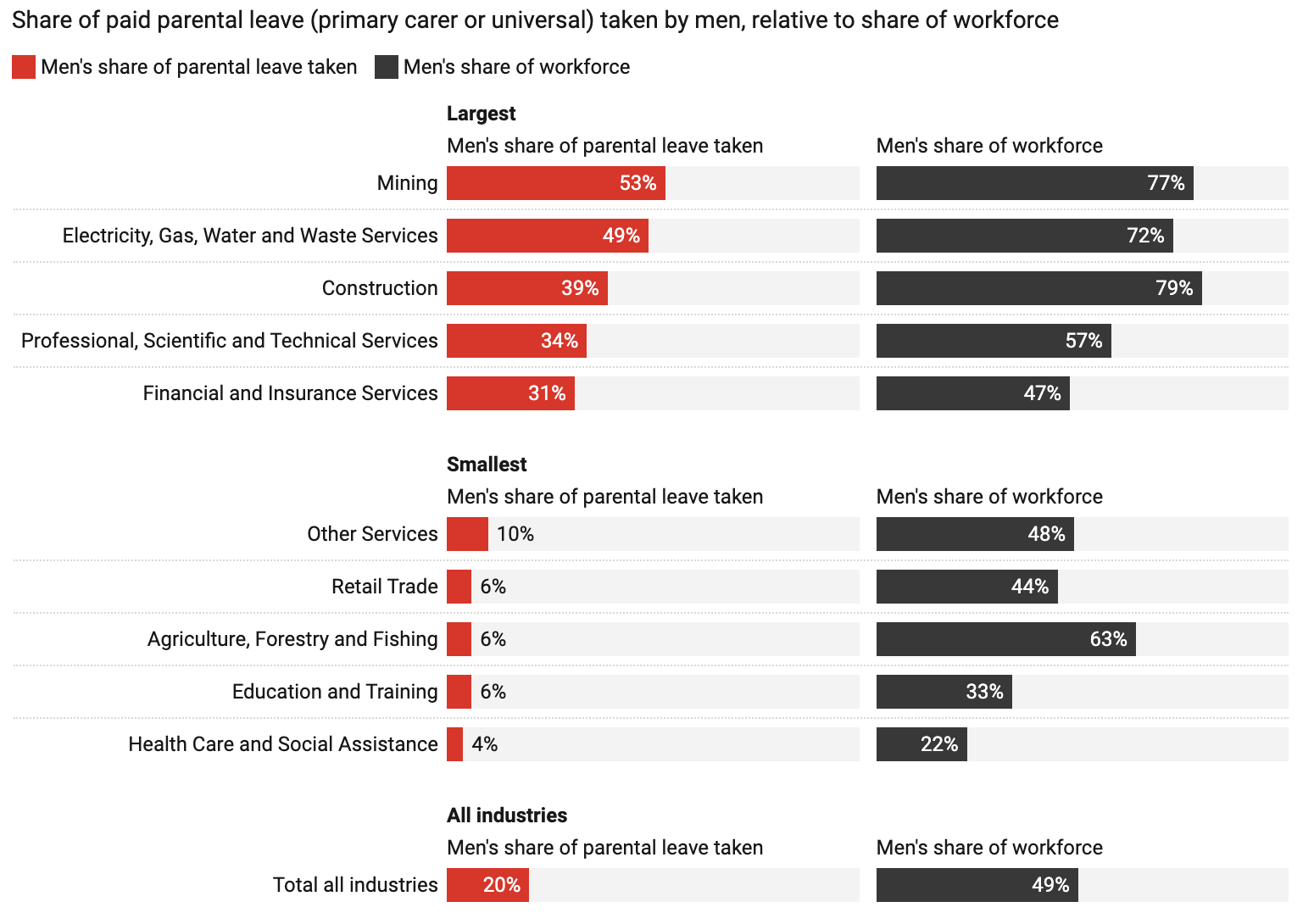

The agency measures the share of total paid parental leave that is been taken by men, with the remaining share being taken by women.

The share of all parental leave being taken by men grew to 20% in 2024-25, a rise of three percentage points from the year before.

These numbers need to be looked at alongside the gender composition of the workforce. Men’s 20% share of paid parental leave is still a minority considering men make up half of the workforce.

In male-dominated industries, we would expect men’s share of paid parental leave to be higher because men make up the majority of workers.

While mining is the industry with the largest share of paid parental leave being taken by men (53%), it’s still well below men’s 77% share of the industry.

Industries with the largest and smallest men’s usage of paid parental leave

Chart: The ConversationSource: WGEA (2025) Australia’s Gender Equality Scorecard 2024-25

The Workplace Gender Equality Agency notes that men’s uptake of paid parental leave jumped notably in the past year in the construction sector, up 12 percentage points to 39%. But that’s still well below men’s 79% share of that industry’s total workforce.

Among the industries with the biggest gaps between men’s share of the workforce and share of parental leave, men in transport, postal and warehousing take 24% of paid parental leave, despite making up 73% of the workforce.

Men working in wholesale trade take just 19% of paid parental leave, even though they make up 62% of the workforce.

Going beyond the minimum requirements

There’s also scope for more employers to offer paid parental leave above government-funded minimum entitlements. Availability is lowest in public administration and safety, and accommodation and food services, where only around one in three private sector employers offer company-funded parental leave.

Often, this type of benefit is used by companies as an attraction and retention tool. Industries with high rates of staff mobility, and less competition for workers, tend to see less payoff in these types of policies.

But often overlooked in debates about paid parental leave are the benefits to men , too.

There’s still much progress to make in shifting workforce culture to make it “the norm” that all parents have the opportunity to participate in caregiving.

By measuring and tracking Australian employers’ gender equality performance and policy actions, the agency’s annual scorecard helps employers and employees realise these benefits.