The power of the core-satellite investing strategy

Discover why having a core-satellite approach to your portfolio is a powerful investment tool.

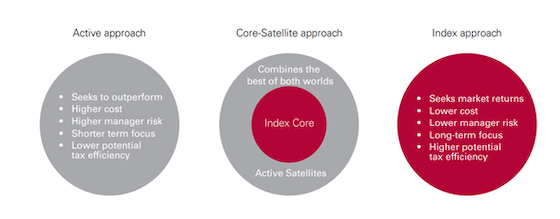

In essence, core-satellite is an investment approach that combines the benefits of index funds—lower cost, broader diversification, tax efficiency and lower volatility— with actively managed funds or other direct investments offering potential for outperformance.

It recognises that there are fundamental differences between index and active fund management but that it doesn’t have to be either-or.

Rather, investors can combine the best aspects of both investment strategies to bring stability and returns to an investment portfolio.

Core-satellite also brings greater discipline and stability to an investment portfolio by:

- Reducing reliance on ‘picking winners’ or chasing returns

- Providing greater portfolio diversification

- Potentially improving after-tax returns by taking maximum advantage of capital gains discounts

- Reducing overall fund management and transaction costs

Research in both Australia and overseas has consistently concluded that asset allocation is by far the greatest determinant of portfolio outcomes.

Security selection and market timing only have minor influence, particularly over the long term.

The core-satellite approach is first and foremost focused on getting an investor’s allocation right and ensuring a diversified mix of assets, and then deciding how much of each asset class to allocate to index and active or individual securities.

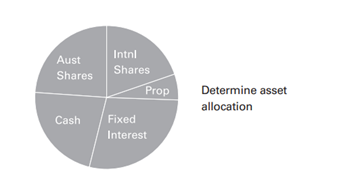

1. Determine your risk profile and asset allocation

Risk profile analysis remains the first step in portfolio construction formulation. An investor’s goals, personal situation, preferences and risk tolerance, all need to be considered to build an investor’s risk profile—then matched to an appropriate asset allocation across shares, property, fixed interest, cash and other assets.

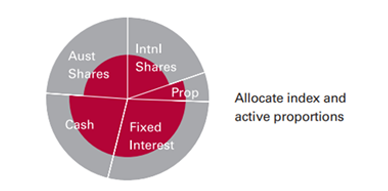

2. Decide how much of the portfolio to allocate to the “core” and “satellites”

Within each asset class, decisions need to be made around the proportion of ‘core’ to be allocated to indexing and the proportion to active management or direct shares. This can be dependent on the level of risk compared to the market an investor is prepared to take on, and the level of tax efficiency an investor desires. The mix of index and active chosen may vary from sector to sector. In some asset classes where the indexing case is particularly strong—for example fixed interest—it may be appropriate to have 100 per cent indexed.

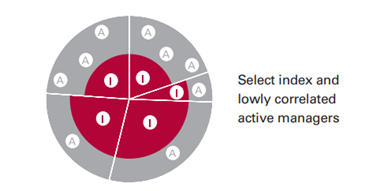

3. Select your investment managers

Finally, you need to decide on an index manager for the ‘core’ (not all index managers are the same), as well as the number of active managers ‘satellites’ chosen to complement the core. Ideally managers selected should correlate differently to the index core. In some sectors you may require only one or two managers, in other sectors you may require more.

Call us today if you would like more information about an investment strategy.

Source: Vanguard June 2024

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing GENERAL ADVICE WARNING Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966). The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”). We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions. Important Legal Notice – Offer not to persons outside Australia The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws. © 2024 Vanguard Investments Australia Ltd. All rights reserved.