Options for adding to your super

Adding to your super

You can boost your retirement savings by making voluntary super contributions, such as by:

- setting up a salary sacrifice arrangement with your employer

- making personal super contributions (and a non-concessional contribution may make you eligible for the government’s super co-contribution)

- transferring any super you have in a foreign super fund

- arranging for your spouse to contribute to your super or splitting contributions with your spouse

- making a downsizer contribution into super if you are selling your home and are 55 years or older.

Small changes you make now can make a big difference to your lifestyle in retirement.

Maximising your super

Consider maximising your super contributions at least 10-15 years before the age you plan to retire. This can make a significant difference to your final super amount.

You can use the MoneySmart retirement planner to work out what your retirement income could be and think about the small changes you can make to build your super, or contact us, we can help put a strategy in place to help you build your nest egg. You should consider how much money you will need to enjoy a comfortable lifestyle in retirement.

In adding to your super, keep in mind:

- work and age restrictions on what deductions you can claim for contributions to your super

- contributions caps, which if exceeded may mean you have to pay tax on the excess

- limits and restrictions on the contributions your super fund can accept.

Keep track of your super and check that you receive all the super you’re entitled to from your employer under super guarantee.

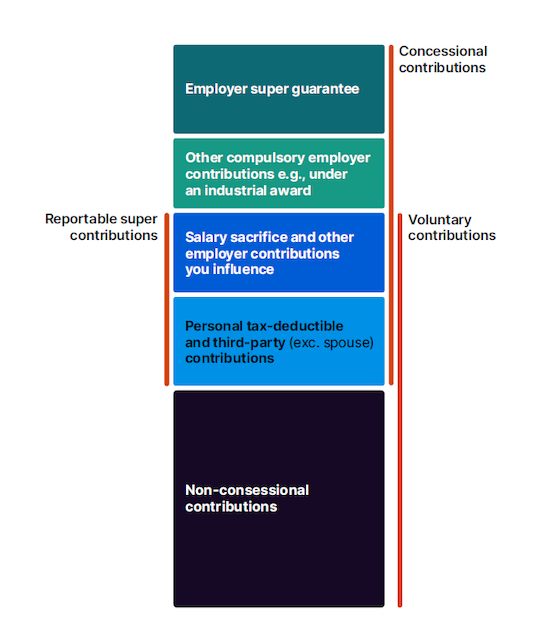

Reportable super contributions

Your reportable super contributions include any:

- personal deductible contributions you make for which you claim an income tax deduction

- reportable employer super contributions your employer makes for you where you influenced the amount or rate of super your employer contributes, such as

- contributions made under a salary sacrifice agreement

- additional amounts paid to your super fund (for example, you directed an annual bonus to be paid to super)

- an increased super contribution as a part of your negotiated salary package.

Reportable super contributions don’t include any compulsory contributions by your employer made under:

- super guarantee

- an industrial agreement

- the trust deed or governing rules of a super fund

- a federal, state or territory law.

You must include reportable super contributions in your tax return.

If your employer makes reportable employer super contributions on your behalf, they must include the total amount of these contributions in the income information they report to us. Reportable contributions made by your employer are shown on your income statement in ATO online services or your payment summary from your employer.

If you make personal contributions for which you have notified your super fund you’ll claim a tax deduction, this will be reported to us by your super fund and pre-filled in your online income tax return.

Main categories of superannuation contributions

What reportable super contributions affect

Your reportable super contributions are not included in your taxable income, but they are added to your taxable income to work out if you meet the income tests for benefits, concessions and obligations we administer such as the:

- Medicare levy surcharge threshold calculation

- Medicare levy surcharge (lump sum payment in arrears) tax offset

- net medical expenses tax offset (withdrawn from 1 July 2019)

- invalid and invalid carer tax offset

- zone tax offset when claiming for dependants

- seniors and pensioners tax offset

- Higher Education Loan Program (HELP) and Student Financial Supplement Scheme (SFSS) repayments

- deduction of your non-commercial business losses

- super co-contribution (income threshold does not include deductions for super contributions)

- low income super tax offset (income threshold)

- the spouse superannuation contributions tax offset (spouse’s income threshold does not allow for deductions, including super contributions)

- income tax concessions available to participants in certain employee share schemes.

If you made a personal contribution and did not claim an income tax deduction for it, the amount is not a reportable super contribution.

As well as affecting benefits, concessions and obligations administered by the ATO, reportable super contributions also affect some payments or services administered by Services Australia.

Check your options for adding to and growing your super. or speak to us for more information.

Source: ato.gov.au August 2023

Reproduced with the permission of the Australian Tax Office. This article was originally published on https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/growing-and-keeping-track-of-your-super/how-to-save-more-in-your-super/options-for-adding-to-your-super.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.