2025 Year in review: It was a soft landing for Australia

Many investors breathed a sigh of relief at having survived (and even thrived) the turbulent economic and political events of 2025.

Super funds posted strong double-digit returns for the 2024-2025 financial year. Australia recorded modest economic growth, while inflation cooled a little throughout the year – albeit with a slight uptick at year’s end – and house prices surged before hitting the brakes in December. Share markets reported respectable gains locally and some surging profits globally.

The big picture

Markets and economies around the world have danced to the tune of the Trump Administration’s second term in office and reacted to wars and unrest in the Middle East and Ukraine.

The US President’s often surprising policy twists and turns, particularly a punishing new tariff regime, saw markets falter and exporters of goods and services to the US plunged into uncertainty.

The Australian dollar reflected the choppy conditions, hitting lows just under 0.60 US cents in April before recovering slightly by year ‑end at just under 0.67 US cents, this was buoyed by our strong iron ore exports and the growing demand for lithium, copper and rare earths. i

The artificial intelligence revolution was another feature of the year, driving US share markets ever higher with some fearing the bubble is overdue to burst.

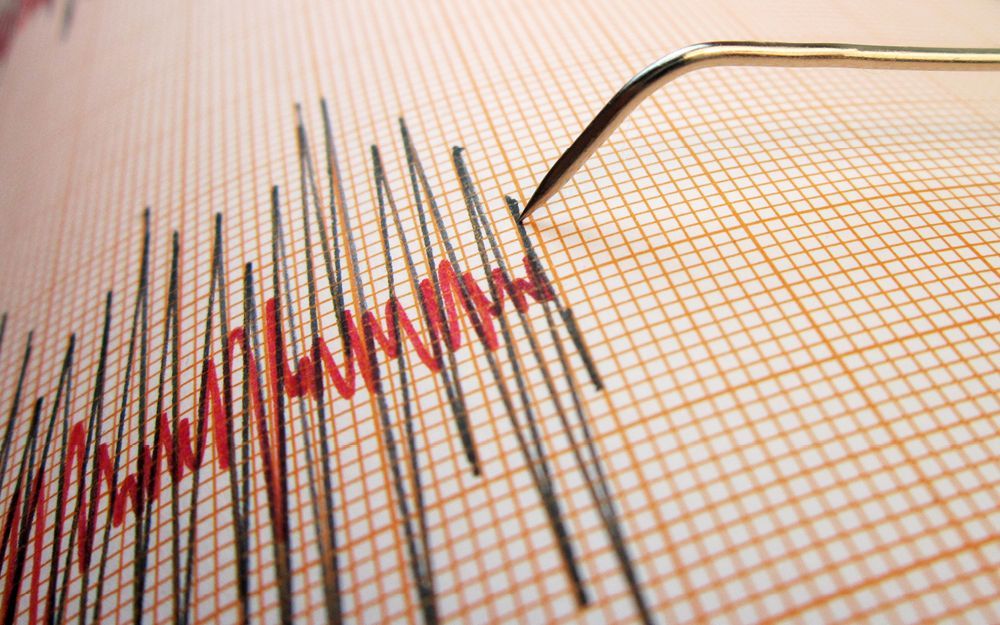

Economy

Inflation’s stubborn resistance to the Reserve Bank’s measures to bring it down could lead to further interest rate rises in 2026.

The Consumer Price Index in January recorded an annual rate of 3.4 per cent, down 0.4 per cent on the previous month. The RBA’s flexible inflation target aims to keep the cost of living increases between two and three per cent.

The cash rate began 2025 at 4.35 per cent but after three cuts during the year, it was down to 3.6 per cent in December. The RBA is due to meet in February to consider its next move.

In the US, the Federal Reserve also cut rates three times, putting the interest rate to a range of 3.5 – 3.75 per cent.

The Australian economy grew 2.1 per cent in the year to September in a massive improvement on the previous year’s growth of 0.8 per cent.

Property

After two uneven years, home values surged again in 2025 by 8.6 per cent, adding about $71,500 to the national median. ii

It’s the strongest calendar year performance since the remarkable 24.5 per cent increase in 2021.

However, values softened in December, recording the smallest monthly increase in five months.

Darwin delivered the best performance with an 18.9 per cent gain in values during the year while Melbourne took the wooden spoon with a 4.8 per cent increase. iii

Share markets

Global equity markets proved that they could thrive, even in a higher-interest rate environment, and the AI revolution moved from the hype phase of the previous year to serious players in 2025.

While ‘The Magnificent Seven’ tech stocks have long ruled the S&P 500, in 2025 just two outperformed the index with a gain of 64.8 per cent for Alphabet and 38.9 per cent for Nvidia. iv

It was a slower pace for Australian markets with the S&P/ASX 200 delivering a solid total return of 6.8 per cent. While the big banks faced some pressure on margins as interest rates peaked, the materials sector was supported by the global energy transition. Dividend yields remained attractive, continuing Australia’s tradition of providing reliable income for retirees and SMSFs.

Commodities

Precious metals drove commodity values in the past year with investors looking for security amid interest rate movements and geopolitical tensions.

Silver was up by an astonishing 182 per cent during the year, but a sell-off in December saw the price finish the year with a 147 per cent gain. v

Meanwhile, gold’s safe haven status during times of uncertainty saw it jump by 65 per cent during the year.

Looking ahead

It seems likely the issues that dominated the financial markets in 2025 will continue to shape performance and returns this year.

Global politics and war are likely to move commodity prices and equity markets while the contrariness of US foreign policy will both spook and buoy investors.

In Australia, all eyes will be on the RBA, with high levels of speculation as to where interest rates will be heading in 2026.