How iron ore plays a big part in our economy

Iron ore has been the backbone of the Australian economy and many investment portfolios for much of the 21st century. Export of the commodity saw Australia evade recession both in the wake of the Global Financial Crisis back in 2008 and the Covid epidemic.

In 2021, resources accounted for 68 per cent of Australia’s export revenue. This was the year that iron ore prices peaked at almost $US230 a tonne.i

Large quantities of iron ore were discovered in Australia as far back as 1822 in Tasmania. However, its growth as an export icon really took off with the first shipment of iron ore from the Pilbara in Western Australia in 1966.

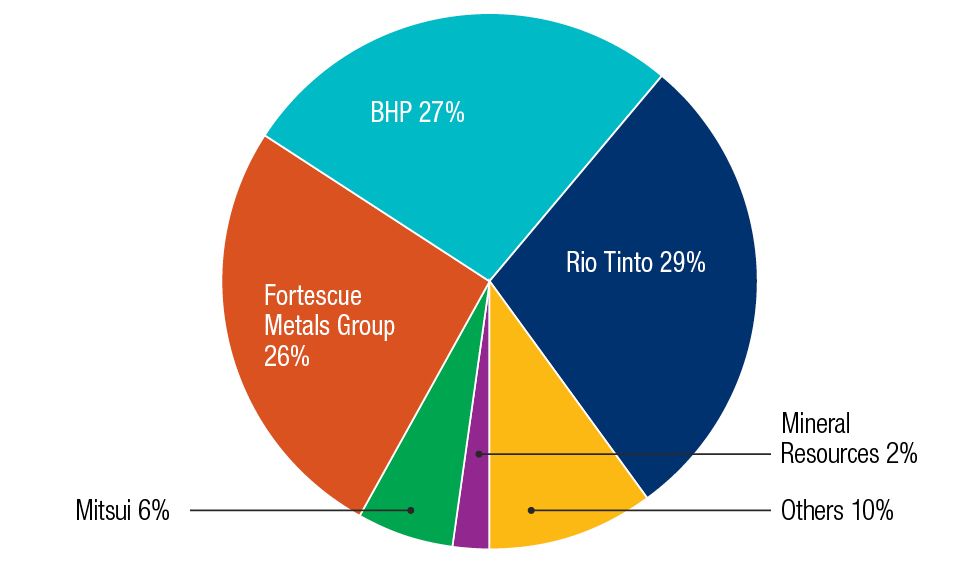

Today there are three major companies that mine iron ore in Australia – BHP, Rio Tinto and Fortescue Minerals. Considered blue chip stocks, they are often favourites with investors and their share price performance is linked to iron ore prices. Together, these miners are responsible for 76 per cent of production in Western Australia and contribute to 38 per cent of global production.ii

Share of iron ore production by company, 2021

Source: GlobalData’s Australia Iron Ore Mining to 2026 report

Iron ore’s importance worldwide stems from its use in steel, a key material used in infrastructure, housing and manufacturing equipment globally. Manufacturing includes such things as cars, ships, trains, trucks and pipelines. Iron ore is also used in cast iron and stainless steel which in turn have many applications.

China’s role

The main recipient of Australia’s iron ore is China. In 2022 China bought 1.1 million tonnes of iron ore, 65 per cent of which came from Australia.iii

The driving force powering this demand was the urbanisation and industrialisation of China. China actually produces more iron ore than Australia but it is at a much lower grade.

No wonder, Australia has been riding on iron ore’s back.

While demand is still high in China, Covid put a dampener on its economic growth when the country basically shut down for an extended period. Its strict measures did not start to roll back until December 2022 and investors began to worry.

While economic activity is slowly resuming, it has reduced significantly from its heady days. As a result, demand for iron ore has also fallen.

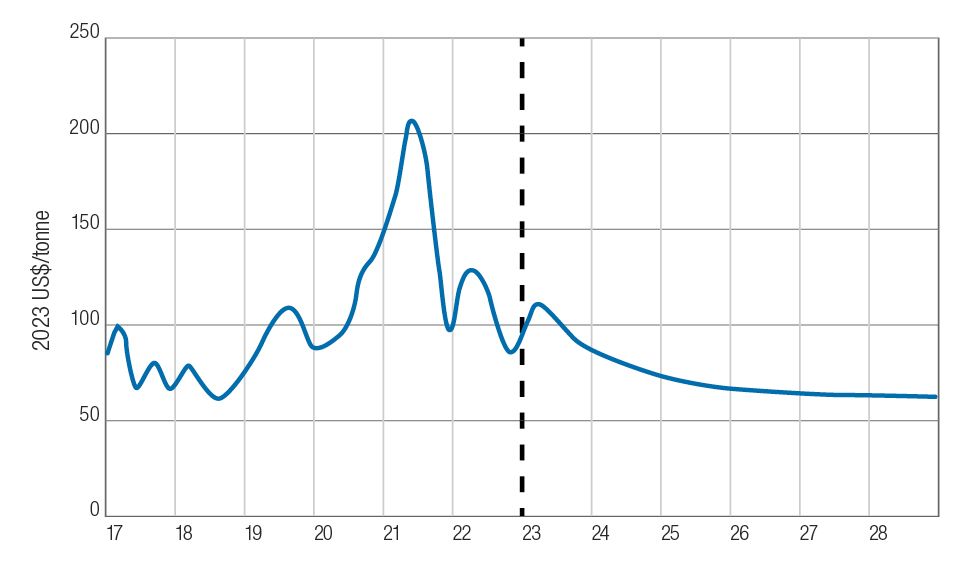

This has seen the price of iron ore drop to around the $US100 a tonne mark from its $US230 million peak in 2021.

Although China’s economy is not performing as energetically as it did a decade ago, Premier Li recently told the World Economic Forum that it was rolling out more measures to boost domestic demand.iv

This has triggered some optimism among market watchers, although there are still bears around who are more circumspect.

Global demand

It is not only in China where demand for iron ore is falling. The rest of the world is wrestling with recession and that too has put a dampener on the market.

Added to this slowdown in demand is the move to increase supply. The major Australian producers and Brazil’s Vale Mining have all got new projects and expansions on the horizon.v

Luckily, iron ore is relatively cheap to mine in Australia, costing Rio Tinto and BHP $US30 a tonne to produce, which means they are somewhat sheltered from price fluctuations. While Rio Tinto and BHP can remain profitable with prices dropping as low as $US60, lower prices will have a flow on effect, impacting superannuation balances, investor returns and the broader economy.vi

Iron ore price outlook, quarterly

Source: Bloomberg (2023), Department of Industry, Science and Resources (2023)

Impact on the economy

Unfortunately, lower profits mean the Australian Tax Office will also receive significantly lower revenue and that in turn will impact on the Australian economy.

While profits are still boosting the government’s coffers, the outlook is less bright.

Tax revenue from iron ore has made a significant contribution to the robustness of the Australian economy and has been a key reason for the recent return to surplus in the federal budget after 15 years of deficits.

In fact, the federal government is expecting the surplus in 2022-23 to be a whopping $19 billion, significantly higher than the $4.2 million original forecast in the May Budget. Not all that growth is attributed to strong commodity prices, but they have certainly played a part.vii

Nevertheless, the domestic economy is still expected to slow as high inflation and global challenges make their mark.

Budget papers estimate that a $US10 per tonne increase in the Commonwealth’s assumed price for iron ore exports is expected to result in an increase in tax receipts of around $500 million in both 2023-24 and 2024-25.viii

But the federal government is still cautious about the economic outlook for Australia and are forecasting a return to a budget deficit and the possibility of a recession as the move to higher interest rates puts brakes on the economy.

Aside from economic performance, any reduction in revenue for the mining companies will also translate into lower dividends and lower price growth for investors.

But despite some bearish sentiment in the market including the growing number of institutional and individual investors steering clear of mining stocks over ethical and environmental concerns, there is no denying that iron ore is still a big money spinner.

If you would like to discuss options for investment in the current economic climate, then give us a call.

i https://minerals.org.au/resources/record-high-for-resources-export-revenue/

ii https://www.mining-technology.com/data-insights/iron-ore-in-australia-2

iii https://edition.cnn.com/2023/05/05/economy/australia-china-exports-record-intl-hnk

iv https://www.reuters.com/world/asia-pacific/chinas-growth-be-higher-q2-projected-hit-annual-5-target-premier-li-2023-06-27/

v https://www.mining.com/iron-ore-price-expected-to-ease-over-next-5-years-on-slower-demand-growth-and-more-supply/

vi https://www.abc.net.au/news/2023-05-30/australian-iron-ore-boom-ending-after-china-rift/102408002

vii https://www.theguardian.com/business/2023/jun/30/australia-budget-surplus-swells-to-19bn-due-to-surging-tax-revenue

viii https://www.watoday.com.au/politics/western-australia/how-wa-s-resource-riches-helped-deliver-the-first-budget-surplus-in-15-years-20230509-p5d725.html

Important: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.